The Legacy of J.P. Morgan: Tracing the History of One of the World's Most Influential Financial Institutions

Discover J.P. Morgan & Co.'s rise to a dominant global financial institution through its founding, mergers, US economy impact, global expansion, and industry influence.

Want to listen instead? Check out the audio version of this article.

Summary:

Introduction: The History and Importance of J.P. Morgan

Early Years: The Founding and Mergers of J.P. Morgan

Role in the U.S. Economy: Shaping Policies and Financial Transactions

Global Expansion: Establishing a Global Financial Institution

J.P. Morgan Today: Recent Developments and Ongoing Impact

Legacy and Impact: Contributions and Influence on the Financial Industry

Conclusion: Significance of J.P. Morgan's History and Legacy

Introduction: The History and Importance of J.P. Morgan

J.P. Morgan is one of the most renowned financial institutions in the world, with a rich history dating back over 150 years. Founded by John Pierpont Morgan in the mid-19th century, the institution has played a major role in shaping the modern financial landscape. Today, J.P. Morgan stands as a symbol of financial power, innovation, and stability, with a reputation that extends far beyond the walls of its headquarters. In this article, we will trace the history of J.P. Morgan from its early days to the present, exploring its key role in shaping the financial industry and the global economy.

Src: Clubic

Early Years: The Founding and Mergers of J.P. Morgan

J.P. Morgan, as it is known today, was founded in 1871 by John Pierpont Morgan, a highly influential financier and banker. The bank was originally known as Drexel, Morgan & Co. and was formed through a partnership between Morgan and Anthony J. Drexel, a prominent banker and financier of the time. The bank quickly gained a reputation for providing innovative financial solutions to its clients and became one of the leading banking institutions in the United States. In 1895, the bank underwent a name change, becoming J.P. Morgan & Co. after Drexel's death. Over the years, the bank continued to grow through a series of mergers and acquisitions, including the 1935 merger with Guaranty Trust Company and the 1959 merger with Morgan Guaranty Trust Company. These mergers allowed J.P. Morgan to expand its reach and solidify its position as one of the most influential financial institutions in the world.

Role in the U.S. Economy: Shaping Policies and Financial Transactions

J.P. Morgan played a crucial role in shaping the U.S. economy throughout its history. The bank was instrumental in financing several large-scale infrastructure projects, including the construction of railroads, bridges, and other public works. Additionally, J.P. Morgan's close relationship with the government gave it significant influence over economic policies, particularly during times of crisis such as the Panic of 1907 and the Great Depression. The bank's involvement in major financial transactions, such as the creation of U.S. Steel and the acquisition of RCA, also helped to solidify its position as one of the most powerful financial institutions in the world.

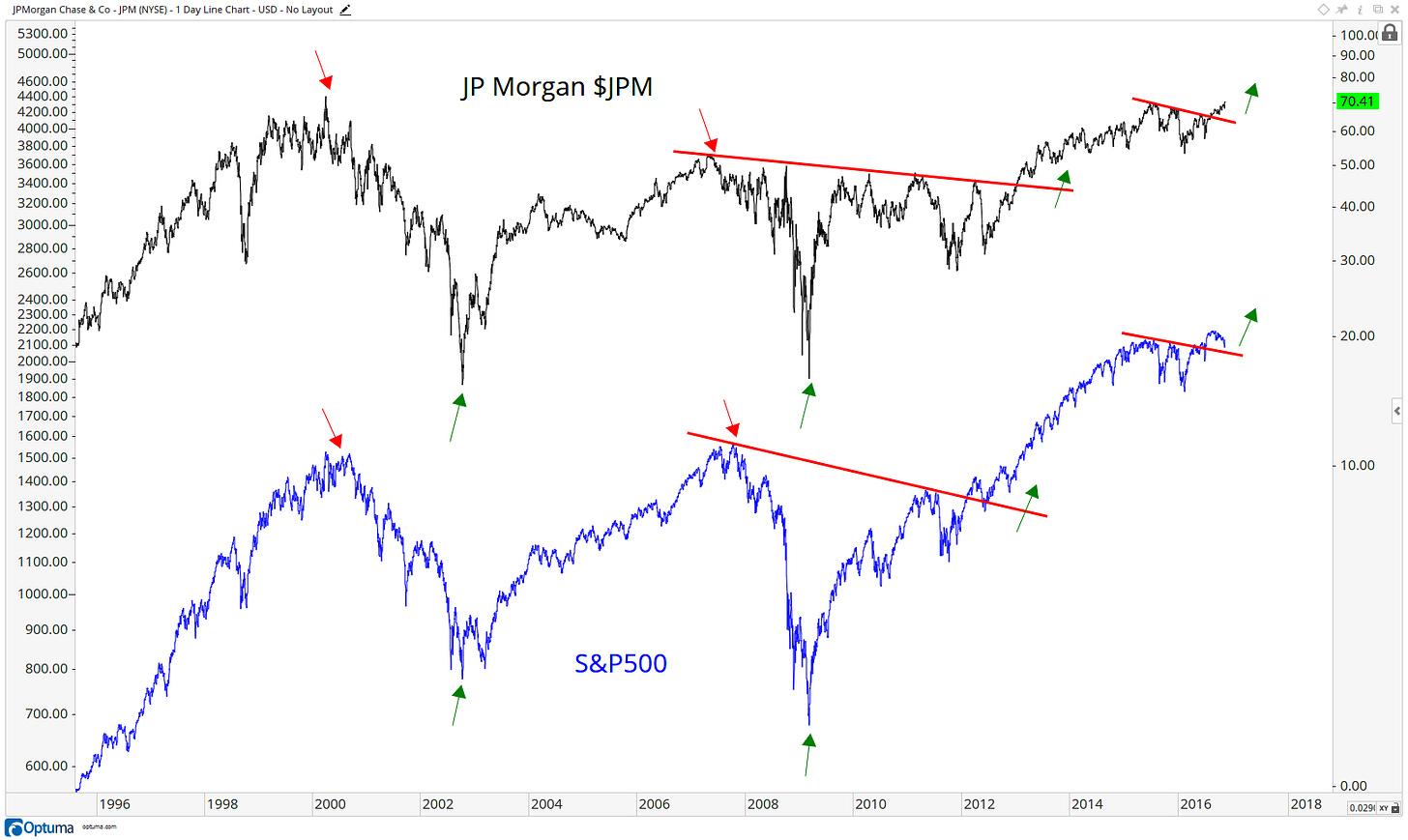

Src: All Star Charts

Global Expansion: Establishing a Global Financial Institution

As J.P. Morgan grew in influence and wealth, it also expanded into international markets, setting up offices and acquiring banks in Europe, Latin America, and Asia. In 1959, J.P. Morgan merged with Guaranty Trust Company of New York to form Morgan Guaranty Trust Company, which further cemented its position as a major player in the global financial industry. In the following years, the bank continued to expand its presence around the world, offering a wide range of financial services to clients in various sectors. Today, J.P. Morgan is one of the largest and most respected financial institutions in the world, with a global network of offices and operations spanning multiple continents.

J.P. Morgan Today: Recent Developments and Ongoing Impact

J.P. Morgan has continued to play a prominent role in the financial industry in the present day. The bank has undergone significant changes and growth, including the acquisition of Bear Stearns and Washington Mutual in 2008. More recently, J.P. Morgan has been focused on expanding its digital capabilities and investing in emerging technologies such as blockchain. Additionally, the bank has faced regulatory scrutiny and fines related to various issues, including the 2012 London Whale trading scandal. Despite these challenges, J.P. Morgan remains a leading global financial institution and continues to have a significant impact on the industry as a whole.

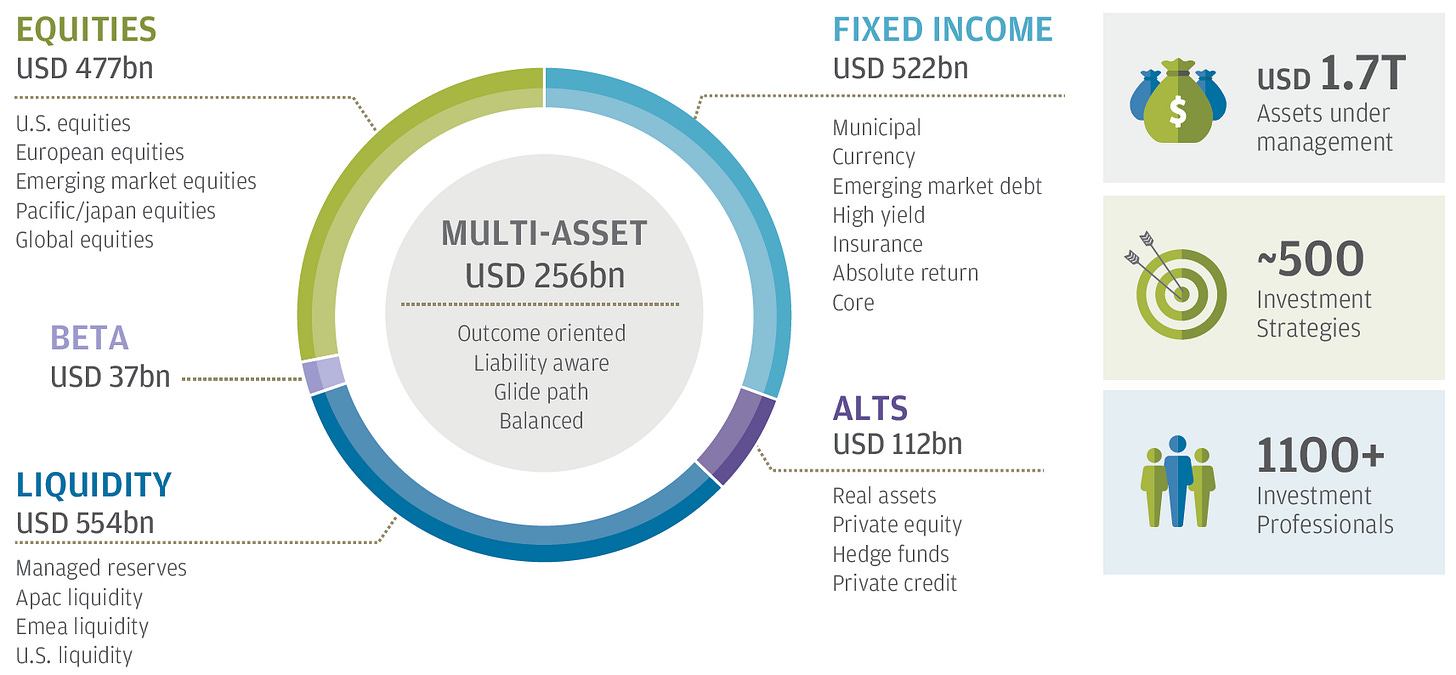

Src: jpmorgan

Legacy and Impact: Contributions and Influence on the Financial Industry

J.P. Morgan's legacy has had a profound impact on the financial industry. The bank's pioneering work in areas such as securities underwriting and mergers and acquisitions helped shape modern banking practices. Additionally, J.P. Morgan's role in financing major infrastructure projects, including the construction of railroads and the Panama Canal, helped shape the course of global economic development. Even today, the bank's influence can be felt in areas such as investment banking and asset management, where J.P. Morgan remains a dominant player in the industry.

Conclusion: Significance of J.P. Morgan's History and Legacy

In conclusion, J.P. Morgan has played an integral role in shaping the history of modern finance and banking. From its early beginnings as a private banking firm to its establishment as a global financial institution, J.P. Morgan has been at the forefront of the financial industry for over a century. Its influence on government policies, involvement in major financial transactions, and contributions to modern banking practices have all contributed to its enduring legacy. Today, J.P. Morgan remains a major player in the financial industry, with a continued impact on the global economy. The history and legacy of J.P. Morgan serves as a reminder of the power and importance of financial institutions in our modern world.

What do you think is the most significant contribution of J.P. Morgan to the modern financial industry?

Share your thoughts in the comments below.

Src: ethicalmarketingnews

📰👀💰Don't miss out on valuable daily information about economics and finance! Subscribe to our free newsletter now and stay informed with our brief 2 to 5 minute reads.😃👍 Don't forget to like this post by clicking the ❤️ under the title of the article so that these Infos can get recommended to more people.

Our Social Medias: Twitter, Instagram, Tik Tok, and Pinterest.

Disclaimer: Please note that I am not a financial advisor and the information provided is my personal opinion, and should not be taken as professional financial advice.