Drug Money Laundering: Its Influence on the Global Economy

Delve into the secretive world of drug money, the second-largest global industry. Explore the covert process shaping our everyday economy.

Summary:

Introduction

The Drug Industry

Money Laundering

Placement

Layering

Integration

Integration

Conclusion

Introduction

Even though the drug business is illicit and shrouded in secrecy, it remains the second-largest industry globally after the hydrocarbons industry, with an estimated $400 billion in annual revenues (exact figures vary depending on sources). While this immense wealth might seem impossible to conceal, major players in the industry adeptly hide and reintegrate these funds into the world economy. This intricate process, insufficiently documented, involves the laundering of billions of dollars by drug cartels, lets dive into the topic.

Src: The Times of India

The Drug Industry

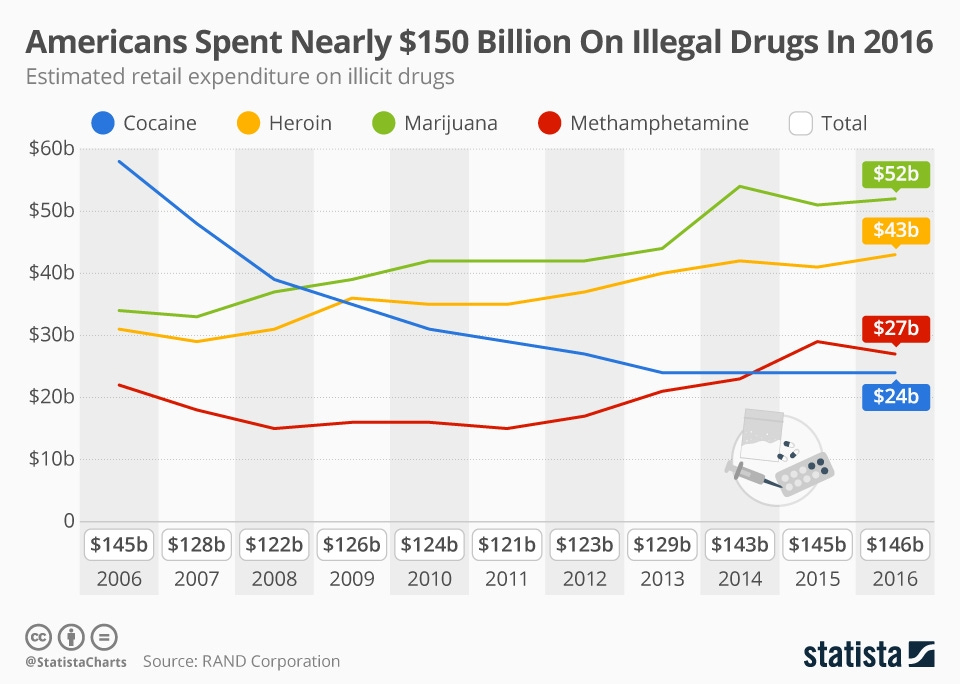

The drug industry is colossal, boasting enormous profit margins. Cartels, major beneficiaries, typically see profit margins around 40% (weed), but this can skyrocket to 2400%, as seen with fentanyl. The substantial markets and revenues grant immense power and influence, making drug money a significant contributor to the global economy. Many people don't realize it, but we all end up being a part of this through the money laundering process, whether we intend to or not.

Find out more about the largest illicit industries and their respective valuations:

Src: Statista

Money Laundering

Money laundering, a term you've likely heard, occurs in three phases:

Src: CruseBurke

Placement

Placement is the initial stage where illicit funds enter the financial system. Criminals aim to "place" their money into legitimate channels to obscure its origin. Common methods include breaking down large sums into smaller deposits to avoid suspicion. For example, someone may deposit $9,000 multiple times to stay below the $10,000 reporting threshold in the United States. Cryptocurrencies and shell companies are also used for placement, making detection challenging.

Methods or Examples of placement in money laundering: Repayment of debt using illegal proceeds. Buying stored value cards with illegitimate money. Depositing small amounts into several bank accounts to evade reporting threshold. It is also called smurfing. (AML UAE)

Layering

Layering involves distancing the illicit funds from their source by creating complex layers of financial transactions. This step aims to confuse authorities and make tracing difficult. Techniques include wire transfers, buying and selling securities, and engaging in high-frequency trading. Criminals may move money across various accounts, countries, and financial instruments. For instance, a money launderer might buy and sell stocks rapidly to create a web of transactions, making it hard to follow the money trail.

Layering can include changing the nature of the assets, i.e. cash, gold, casino chips, real-estate, etc. Complex layering schemes involve sending the money around the globe using a series of transactions. The more countries the money enters and leaves, the harder it is to uncover the “dirty” source of the money. (dowjones)

Integration

Integration is the final stage where laundered funds are reintroduced into the economy, appearing legitimate. Criminals invest the "cleaned" money in legal businesses or assets. Real estate, luxury goods, and businesses are common choices. For instance, a money launderer may use illicit funds to purchase high-end properties, creating the appearance of lawful wealth. Integration makes it challenging for authorities to distinguish between legitimate and laundered assets, completing the money laundering cycle.

It is at the integration stage where the money is returned to the criminal from what seem to be legitimate sources. Having been placed initially as cash and layered through a number of financial transactions, the criminal proceeds are now fully integrated into the financial system and can be used for any purpose. (About business crime solutions)

Integration

The final phase of the money laundering process involves reintegrating the funds into the economy. This stage is particularly intriguing as it reveals that we, and the products we encounter daily, are partially financed by illicit drug money. Once criminals and money launderers have cleansed the funds, they must reinject them into the system. Typically, the "clean" money finds its way into accounts in tax havens to leverage banking secrecy and the opaque nature of these financial systems. Subsequently, they often invest these funds in significant projects such as real estate, businesses, and innovation—all conducted discreetly. Remarkably, the businesses receiving these investments are usually unaware that the funds originate from illicit drugs. This clandestine nature underscores the immense potency of the current money laundering process, making it exceedingly challenging to distinguish between clean and illicit funds. The advent of recent technologies like cryptocurrencies has further facilitated criminals in laundering money.

Src: CBRE UAE

Conclusion

This article highlights the power of the evolving money laundering process, adapting to new regulations and technologies. As individuals contributing to the world's economy, it's crucial to recognize that unintentionally, we are all part of the money laundering process. Though shorter than usual, I hope you found this article insightful. thanks for reading.

Src: Britton & Time Solicitors

How do you perceive the intricate connections between drug money laundering and its subtle impact on the global economy, and what measures could be taken to address this covert influence?

let me know in the comments.

Dive Deeper: Unlock Insights with Recommended Articles on Money Laundering and its impact on the economy:

If you have inquiries about the finance, business, geopolitical and economic realms, the article crafting process, or suggestions for future topics, don't hesitate to reach out. Your support is valued and appreciated.