Driving Change: The Arrival of Chinese Car Brands in the European Market

3 million electric cars: BYD's ambitious 2023 goal challenges Tesla. As Chinese automakers infiltrate Europe, who will reshape the landscape and how?

Summary:

Introduction

The Chinese Invasion Strategy

Multibrand Tactics: Great Wall Motors and SAIC Motor

Geely's Covert Success with Polestar and Lotus

Verdict on Entry Strategies

European-Customer Centricity: The Hyundai Blueprint

Scale and Credibility in the EV Market

Europe's Permeability to New Entrants

Conclusion: Shaping Europe's Automotive Future

Introduction

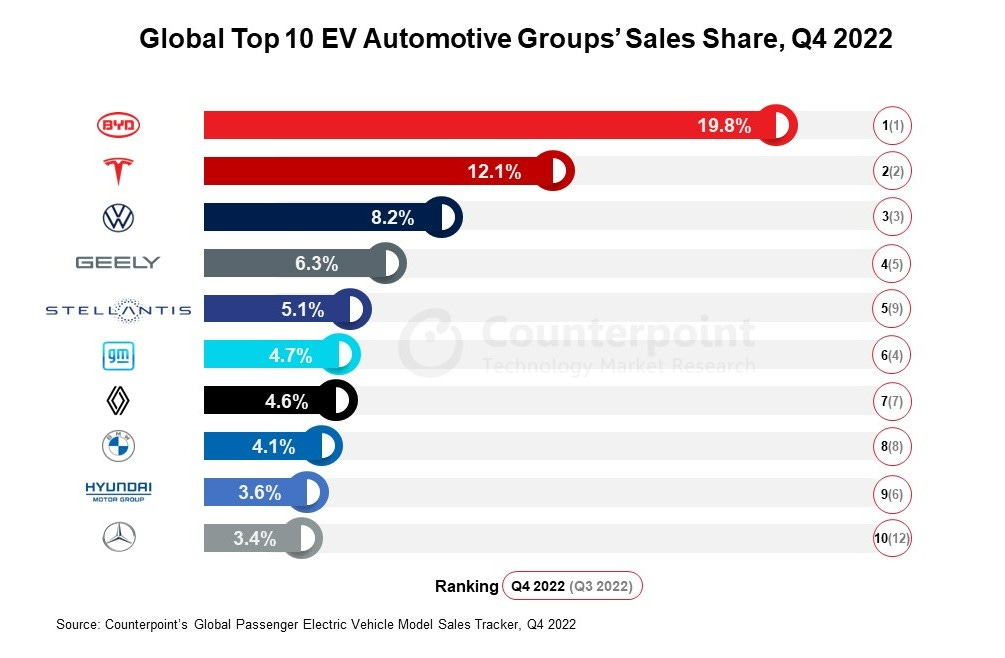

Chinese car brands are gearing up for a significant shift in the automotive landscape as they set their sights on the European market. BYD, a major player in the electric vehicle (EV) sector, plans to sell 3 million EVs in 2023, surpassing Tesla's target of 2 million. This article delves into the strategies and performances of Chinese car brands, examining their potential impact on established players in the European automotive arena.

The Chinese Invasion Strategy

Chinese car brands are adopting diverse strategies to enter the European market. BYD, a global EV leader, follows a 'pureplay' foreign-brand strategy. Leveraging lessons from past market entries, BYD focuses on establishing a robust dealer network in countries like Sweden and Germany. This strategic approach mirrors successful entries by Tesla, Hyundai, and Kia over a decade ago, emphasizing the importance of building a strong foundation from the outset.

BYD's European foray started in Norway in 2021. The company rolled out three EVs in Europe in October 2022, marking an official launch in the region. According to Lin, BYD sold 4,083 vehicles in Europe last year, up 282% from 2021. (DigiTimes)

Multibrand Tactics: Great Wall Motors and SAIC Motor

Great Wall Motors takes a different route with a multi-brand strategy, introducing Wey and Ora to lead the way. Partnering with Europe's largest dealer group, Emil Frey, Great Wall Motors aims to cater to different market segments. Ora targets the lifestyle-oriented mass market, emphasizing affordability with initiatives like 24-hour test drives and leasing rates starting at €149. On the other hand, Wey positions itself as a 'premium SUV brand,' offering an attractive plug-in hybrid (PHEV) under €60,000.

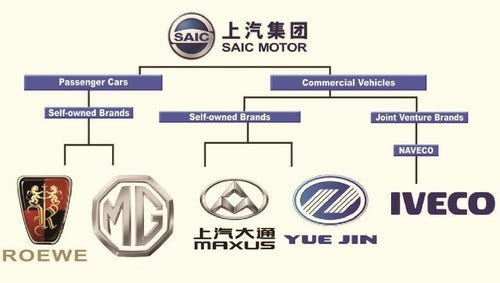

SAIC Motor also employs a multibrand approach with Maxus, specializing in all-electric light-commercial vehicles, and MG, an established European brand revival. MG's electric models, boasting competitive ranges and affordable pricing, exemplify SAIC Motor's commitment to diverse market penetration.

Src: SAIC naiec

Geely's Covert Success with Polestar and Lotus

Geely, having acquired Volvo, adopts a partly covert approach with Polestar, positioning it as an electric performance brand with startup appeal. Sharing platforms and dealer networks with Volvo, Polestar benefits from established associations and represents a more niche offering. Geely also introduces two Chinese brands to Europe, Lynk&Co and Zeekr, diversifying its market presence.

Src: Zhejiang

Verdict on Entry Strategies

The verdict suggests that while there's no one-size-fits-all approach, the risks vary based on the chosen strategy. Covert entries leveraging established European brands offer a pragmatic and swift option, particularly in circumventing potential political sensitivities. However, this approach limits scalability and individual brand thrust. Conversely, pureplay strategies and multibrand tactics offer higher scalability but come with substantial risks and the challenge of differentiating efforts effectively.

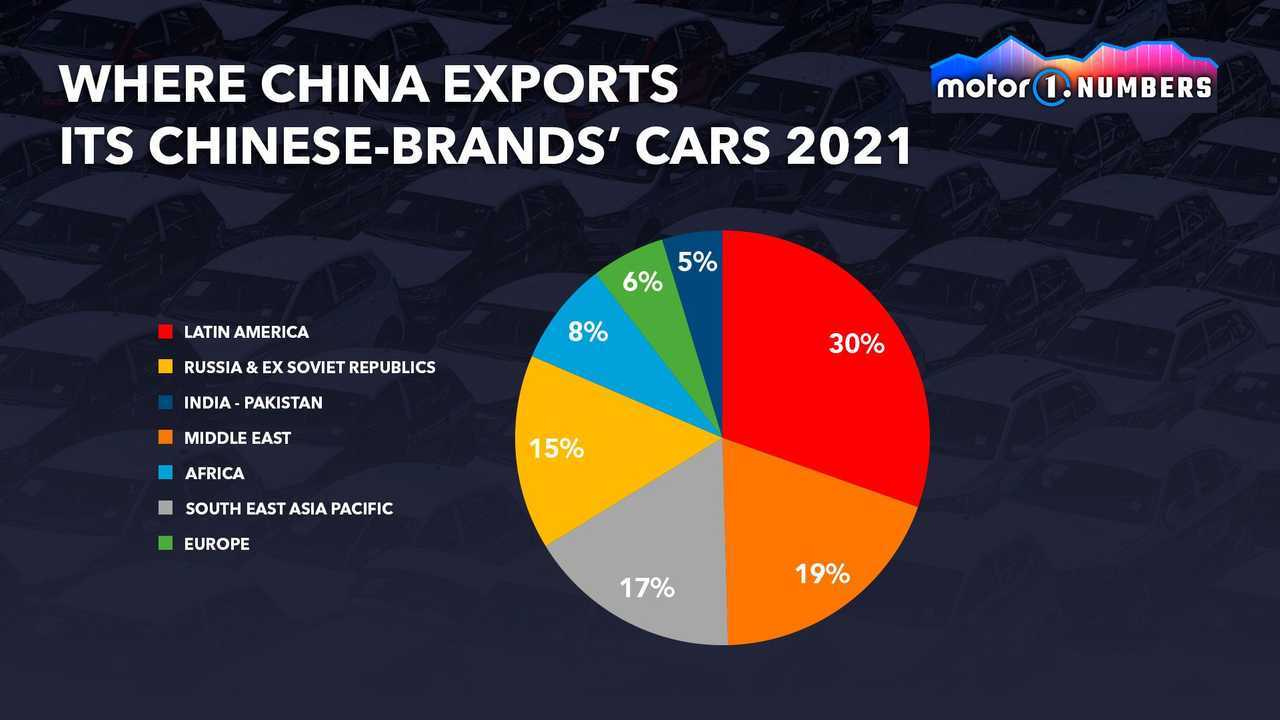

Src: Motor1

European-Customer Centricity: The Hyundai Blueprint

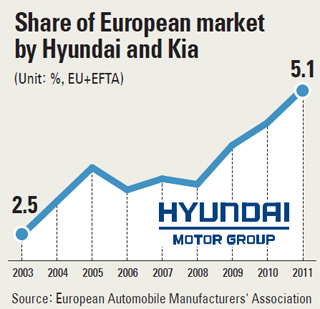

Hyundai's success in Europe provides a blueprint for newcomers. By emphasizing European-centric design, product specification, and decision-making, Hyundai achieved success in mainstream vehicle segments and SUVs. This approach laid the foundation for upmarket initiatives, including performance brand 'N,' and the launch of new brands like Ioniq and Genesis.

Src: JoonAng

Scale and Credibility in the EV Market

In the realm of EVs, Chinese brands like BYD, Geely, and Great Wall Motors have demonstrated impressive performance in their home markets. BYD's 1.2 million EV sales in China during H1 2023 surpass Tesla's figures, signaling a formidable presence. The ability of these brands to replicate their success in Europe hinges on factors like technology, product appeal, and effective value propositioning.

China EV maker BYD to build first Europe plant in Hungary, Frankfurter Allgemeine Sonntagszeitung reports (Reuters)

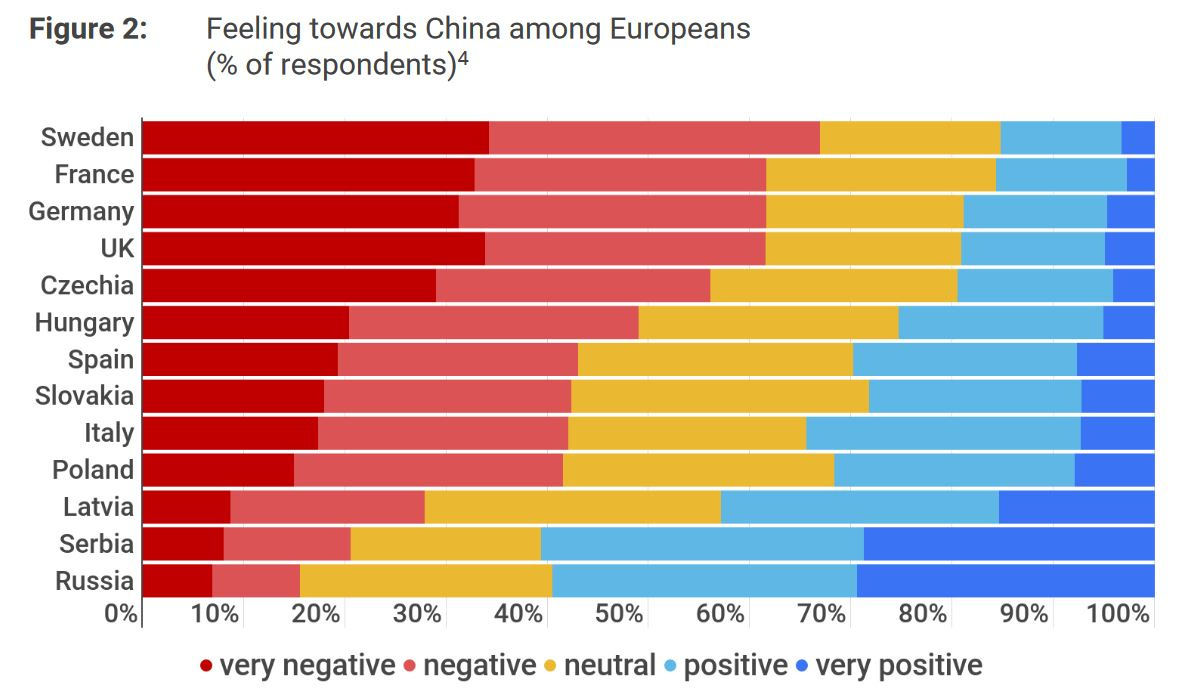

Europe's Permeability to New Entrants

Europe presents opportunities for new entrants, especially in smaller/budget cars, EVs with mass-market appeal, European-designed vehicles, SUVs/crossovers, and technological superiority in infotainment systems and electric powertrains. However, challenges exist, including strong domestic premium brands, a crowded market, and specificities around body styles and brand preferences.

Src: The Diplomat

Conclusion: Shaping Europe's Automotive Future

As Chinese car brands infiltrate the European market, the industry stands at the precipice of change. Speed, scalability, and a customer-centric approach will be pivotal for success. The influx of affordable, mass-market-compatible EVs offers promise, yet the challenge lies in enriching global decision-making with Europe-centric thinking to unlock the full potential of these brands.

Src: Global Times

Amidst the influx of Chinese car brands in Europe, which strategic approach – covert, pureplay, or multibrand – do you believe holds the key to long-term success in the dynamic automotive landscape?

let me know in the comments.

📰🚀 Stay informed with our daily economic insights! Subscribe now for concise updates. ❤️ Help spread knowledge!

Datas From: Autovista24

Disclaimer: Please note that I am not a financial advisor and the information provided is my personal opinion, and should not be taken as professional financial advice.