China's Real Estate Crisis: Debt Burden and Economic Consequences

China's real estate sector faces a mounting debt crisis as major developers like Evergrande struggle, causing construction delays and leaving homebuyers dissatisfied.

Thank you for reading! Sit back, sip ☕, and enjoy. Follow me on Twitter (@Business_uub) for more insights and news 📰. Subscribe for 1 valuable article every 2 days. Happy exploring! 🔥

Summary:

Introduction

Significance of the Real Estate Sector and Debt Crisis

Scale and Importance

Evergrande and the Wider Impact

Ponzi-like Nature of the Real Estate Sector

Regulatory Challenges and Incentives

Concerns of Middle-Class Mortgage Holders and Consumers

IMF's Perspective and the Need for Action

Strains on Local Governments and Fiscal Implications

Global and Chinese Economic Outlook

Conclusion

Introduction

🏢📉 China's real estate sector plays a significant role in the country's economy. However, the mounting debt crisis is causing construction delays and leaving homebuyers frustrated and concerned. In this article, we will explore the scale and significance of China's real estate sector, the challenges faced by developers like Evergrande, the Ponzi-like nature of the industry, regulatory challenges, consumer concerns, and the urgent need for action to address the crisis.

Context:

The real estate crisis in China was initially triggered by government efforts to rein in the ballooning debt. These moves aimed to address the risks associated with excessive borrowing and speculative investments in the sector. However, the measures implemented had unintended consequences, leading to a slowdown in the real estate market and impacting developers, homebuyers, and the overall economy.

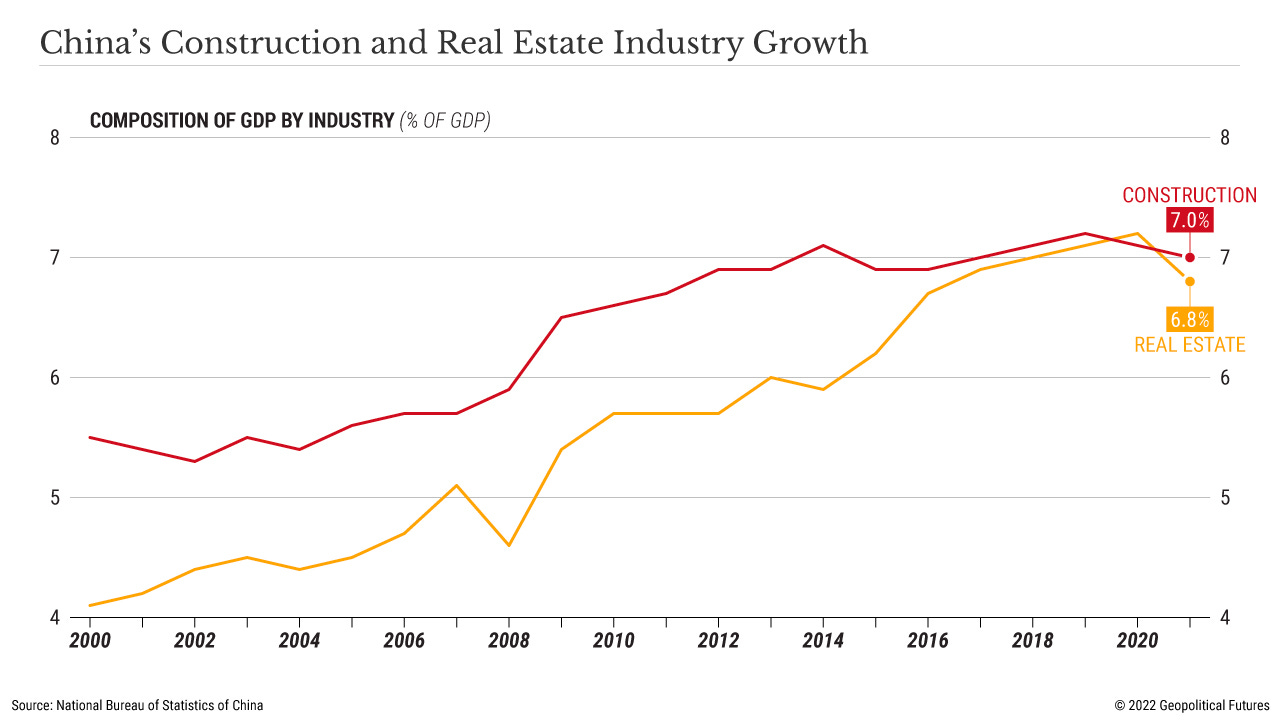

Src: Geopolitical Futures

Significance of the Real Estate Sector and Debt Crisis

🌍 China's real estate sector holds great importance, contributing a substantial 25% to the country's GDP. This sector has been considered "too big to fail" due to its economic impact. However, the current crisis challenges this assumption as the real estate market experiences a contraction of around 7%. The debt crisis has become a pressing concern, threatening the stability of the sector and the wider economy.

Scale and Importance

💰 The immense contribution of the real estate sector to China's GDP underscores its significance. However, the contraction in the market raises concerns about its sustainability. The economic implications of a distressed real estate sector cannot be ignored, as it affects various sectors and stakeholders.

China had 3.5 billion square feet of finished but unsold apartments in February, according to Wind, a data provider. That is equivalent to around 4 million homes, according to some estimates. (livemint)

Src: Reddit

Evergrande and the Wider Impact

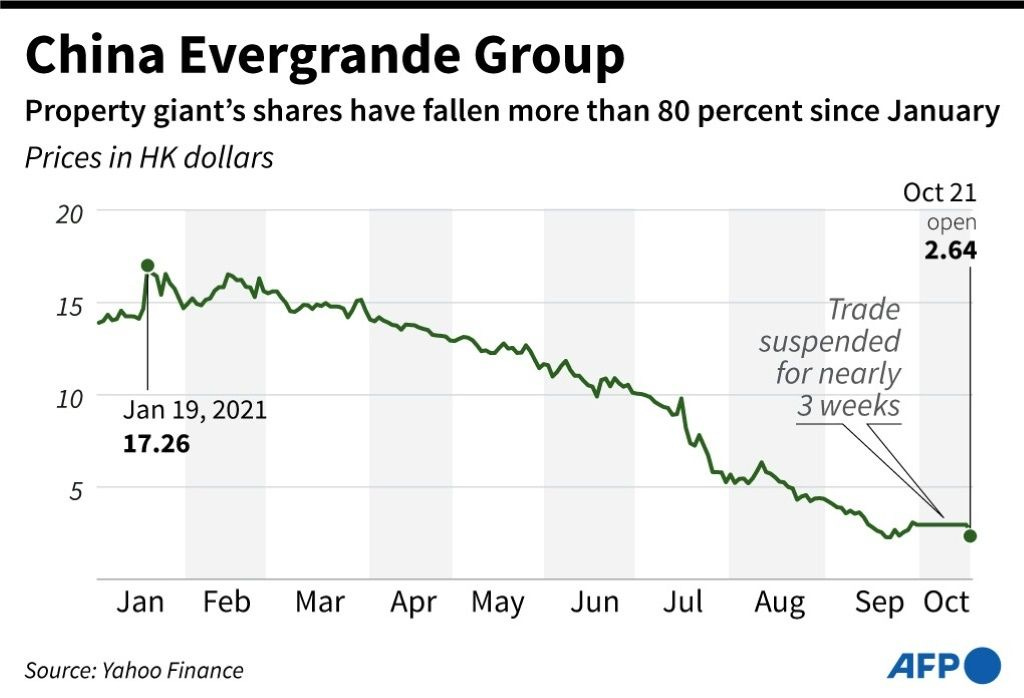

🏘️ The struggles faced by Evergrande, one of China's largest property developers, have sent shockwaves throughout the real estate market. With mounting debt and difficulties in meeting financial obligations, Evergrande's troubles have a domino effect, impacting other developers and home construction projects. The financial instability has led to delayed construction, affecting homebuyers and causing disruptions in the housing market.

Src: International Business Times

Ponzi-like Nature of the Real Estate Sector

💸 The real estate sector in China has been compared to a Ponzi scheme. Developers rely on pre-sales for properties that are yet to be built, using the funds to finance new projects. However, economic downturns or loss of investor confidence expose the vulnerability of this model. If investors lose faith in debt management or the economic environment deteriorates, the real estate market faces considerable strain.

Roughly 90% of new properties in China were pre-sold last year. (qz.com)

Src: thesocialmaverick

Regulatory Challenges and Incentives

🚧 During boom periods, there is little incentive for regulatory intervention in the real estate sector. High sales and demand lead to high borrowing, making stakeholders reluctant to regulate the industry. The introduction of the "three red lines" policy aimed to control debt and restore stability, but its effectiveness is yet to be fully realized. Stricter regulations during boom times can help mitigate the potential damage during a downturn.

Concerns of Middle-Class Mortgage Holders and Consumers

🏡 Middle-class homebuyers, who form a significant portion of the real estate market, are growing increasingly concerned. Unfinished projects, construction delays, and mounting debt of developers have led to frustrations among mortgage holders. The government's ability to deliver on promises and provide a better life for citizens comes into question, impacting consumer confidence in the sector.

Src: Fortune

IMF's Perspective and the Need for Action

💼 The International Monetary Fund (IMF) has raised concerns about China's real estate problems. It emphasizes the urgency for additional measures to address severe financial difficulties faced by developers and the large stock of unfinished apartments. The IMF calls for a comprehensive plan to restructure the sector, absorb potential losses, and restore stability. Failure to act promptly could prolong the crisis and hinder the broader economic recovery.

The Spillover Effects of a Downturn in China’s Real Estate Investment

The Official PDF Download Link By The IMF

Strains on Local Governments and Fiscal Implications

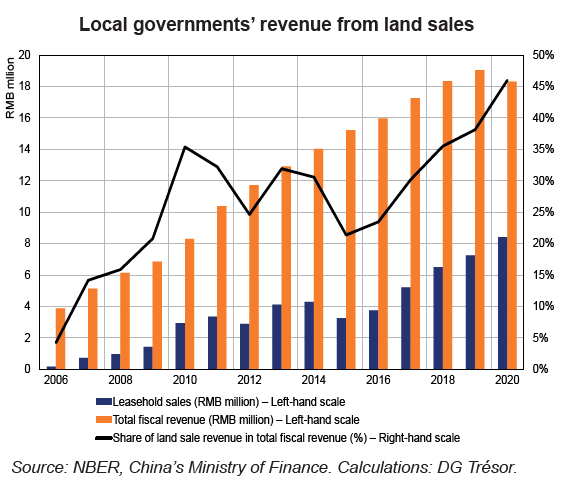

💸 Struggling real estate market conditions have put a strain on local governments. Reduced land sale revenues have affected their fiscal capacity, while local government financingvehicles (LGFVs) have taken on significant land purchases, further complicating the situation. The financial implications for local governments are significant, requiring careful management to ensure long-term economic stability.

Src: tresor.economis.gouv

Global and Chinese Economic Outlook

🌍💼 The IMF's updated growth forecasts for both the global and Chinese economies play a crucial role in understanding the urgency of addressing the real estate crisis. The real estate sector's contraction and the associated risks pose challenges to China's economic growth. The projected growth rate of 5.2% for China in 2023 highlights the need for immediate action to stabilize the sector and support broader economic recovery.

Src: Bloomberg

Conclusion

🔑 The China real estate crisis is a pressing issue with wide-ranging consequences. The mounting debt burden and construction delays impact developers, homebuyers, local governments, and the overall economy. Urgent measures are required to address the crisis effectively, including stricter regulations, debt restructuring, and restoring confidence in the sector. By taking decisive action, China can navigate through the challenges and pave the way for a more stable and sustainable real estate market, ensuring long-term economic growth and prosperity.

Src: CNBC

What are your thoughts on China's real estate crisis and its potential impact on the global economy?

Share your insights in the comments below! 👇

Stay informed with our daily newsletter on economics and finance! Subscribe now for valuable insights delivered straight to your inbox. Don't forget to like and share this post to spread the knowledge! 👍📰🔥

Informations From: CNBC & Marketplace & Focus.cbbc

Disclaimer: Please note that I am not a financial advisor and the information provided is my personal opinion, and should not be taken as professional financial advice.

Interesting article!